What if we told you that now more than ever it is pivotal for you to take your financial security into your own hands? What if one small measure taken today could be the main foundation of securing your financial future

Most expats pay into many different systems throughout their lives, but in the end, end up receiving less than any other person who just stuck to one system and some additional provisions.

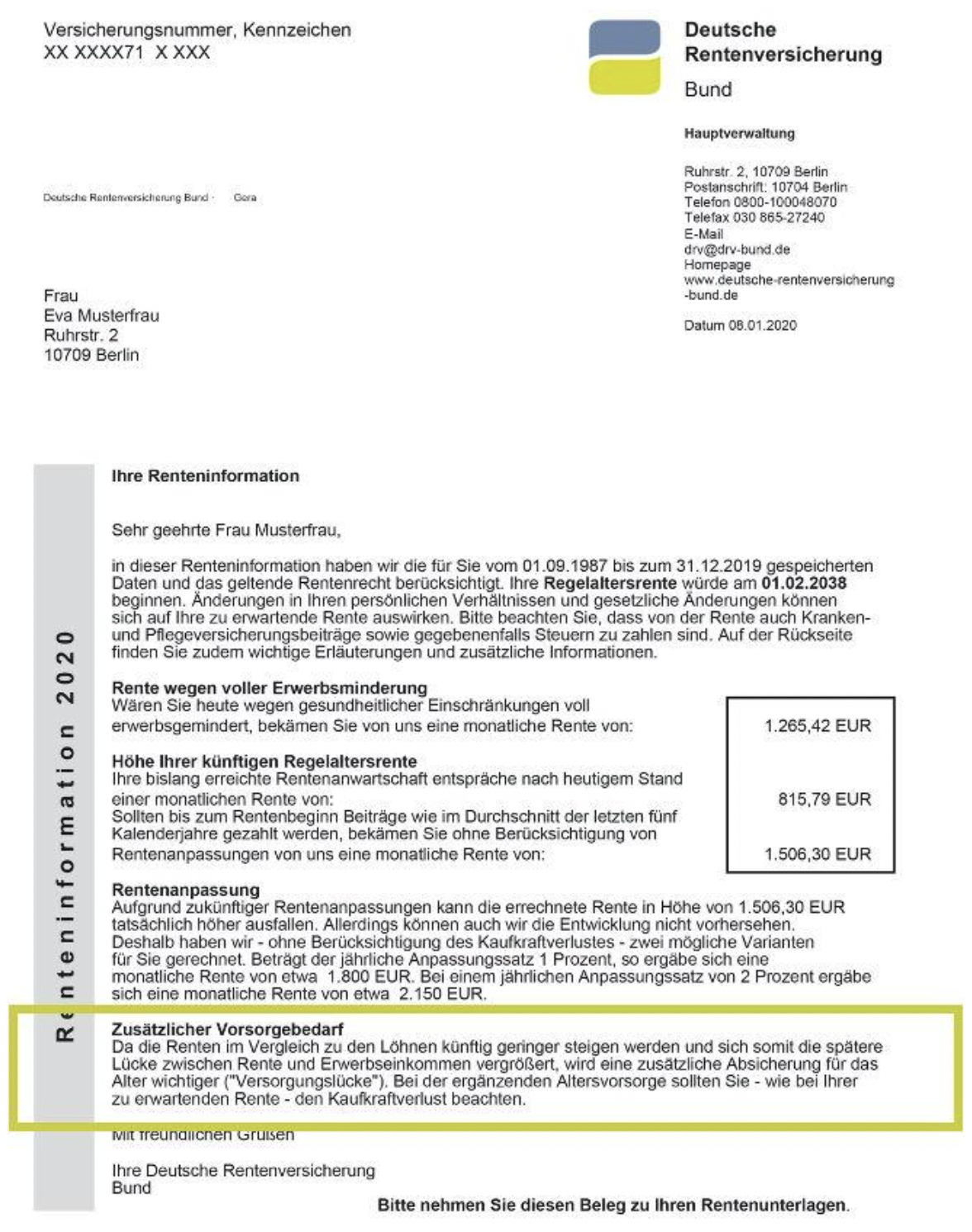

Everyone in Germany who is only relying on the statutory system for their pension has a significant personal gap. Self-employed people have even a greater responsibility to start early!

Requirement of additional provision

Since the future pensions will proportionally rise less in comparision to wages – thus increasing the future pension gap even further – the requirement for additional provision to close that gap is even more important.

Furthermore, for both your supplementary provisions and the statutory pension, you should beware of the loss of purchasing power.

The Silent Threat: Old Age Poverty

As you can see in the image above, the situation has become so relevant that the government proactively encourages employees to take out additional provision to compensate and make sure people get to live decently during retirement and not below minimal conditions.

Did you know that you are legally obliged to conduct long-term financial planning?

In fact, it is mandatory that most people working in Germany pay a small part of their income to the German state. More precisely to the so-called “Gesetzliche Rentenversicherung” (social pension fund). For expats who have paid into many different systems across the world, please get in touch so that we can assess at which point you would be able to qualify for the statutory system benefits in Germany since there are unique exceptions to the normal 5 year period.

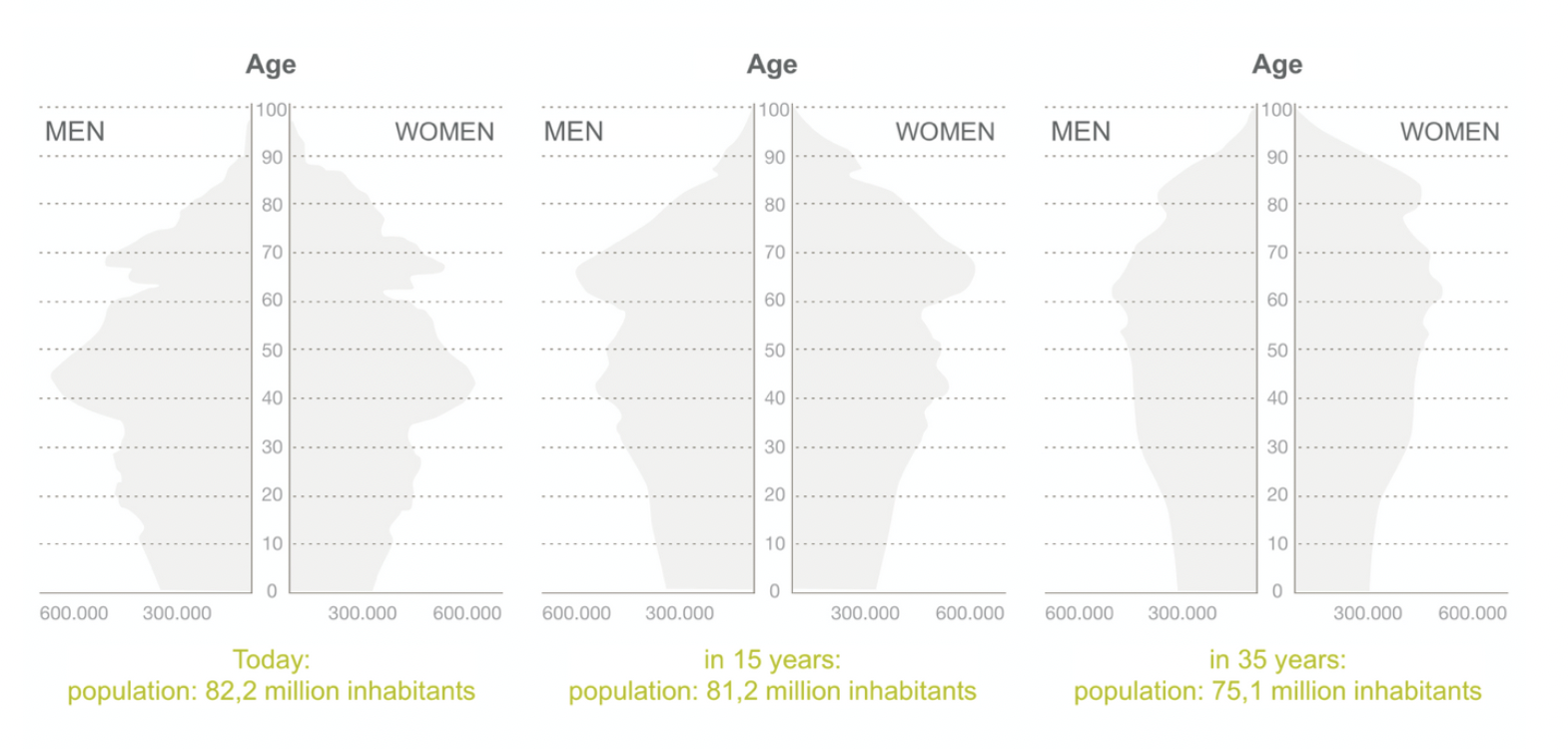

With the collective budget, the state dispenses payments to the current pensioners. Unfortunately, this system faces two grave problems: 1. Your money is spent right away and not saved up for your own pension. The amount you contribute with monthly and what you receive during retirement is not equal. 2. Demographics continue to change: – An increasing decrease in childbirth and the rise of the elderly population – Life expectance simultaneously continues to increase This leaves a very sparse sum to distribute among pensioners. This means that when you retire you will receive significantly less than you contributed. At best. In fact, the situation is so critical that the official webpage of the state’s system strongly advises workers to privately contribute to closing the gap by adding extra building blocks.

Demographic Changes and the Generational Contract

Does this concern anyone under 60? Yes!

Due to the inefficiency of the system, it is strongly advised to take care of your pension gap as soon as possible, because it is predicted that this system will be insufficient in the long run.

Luckily, Germany’s so-called “three-layer system” allows for complementary constellations aiming at the best possible coverage.

Do these layers fill the gap?

It is a carefully planned combination of all three that which guarantees the best possible coverage and if done in time then contributes to closing the gap, yes.

What is more, each layer provides different add-on benefits (flexibility, tax-benefits, savings, subventions, etc) on top, which you can profit from regardless of how long you decide to stay in Germany.

Nevertheless, which ones make the most sense for your individual situation should be individually checked.

For this, we invite you to sign up for a cost-free consultation so that we can assess this further and advise you on how to mix-and-match building blocks in the most optimal way.

First Layer

Includes the statutory pension and the Rürup pension.

Rürup This model entitles some people to a tax deduction while saving up before retirement. It’s the least flexible from all three layers, hence not applicable to all expats, but for those who can profit from it, the Rürup can save them taxes while helping close the gap. The investment mechanisms behind the Rürup can be very attractive and even if you leave Germany these could generate high yieldings over time.

In 2020, 90% of the contributions can be set off against tax liability. If you are also paying into the statutory system, the maximum sum you can contribute to the Rürup is determined by how much you are paying into the former. Despite it being a private contract, you get to perceive the money only once you reach the statutory prescribed retirement age in Germany (67 currently, it can be reduced 63 if you are willing to receive 0.3% less pension per every early month you enter retirement, and 62 is an exception if you are disabled) and you can only receive it as a monthly basis. This nevertheless makes the Rürup a secure option that will guarantee you perceive something during retirement with the added bonus of significantly having saved taxes before retirement.

Second Layer

Holds Riester and company pension scheme (bAV)

Riester The former is a piggy bank with two slits, available for a selected group: not only you invest for your future, but the state does as well providing you with either tax benefits or subventions, even as a student! It is especially attractive for those who have children, too.

In economics, we speak about the “leverage effect”, which makes the Riester a very profitable investment in the long term. More so that a normal capital market investment plan. It is interesting to add that what you pay into it is guaranteed.

In this case, the one doing the leverage is the German state, rewarding contributors to Riester contracts with yearly subventions into their contracts.

175€ annually, 300€ per child (born after 01.01.08, otherwise 185€) on top. If you are under 25 you get a one-time starter bonus of 200€, too. They reward this selected group of people because they were affected by one of the biggest budget cuts that the statutory system underwent.

With a Riester contract, you need to make sure the investment engine making your money work for you is cost-efficient and generates stable yieldings. What is more, how much you should contribute and whether you can do this with your partner or not should be analyzed in detail beforehand. Contributions are capped at 160,42€ a month, but this does not by far mean that you individually should be contributing the entire sum to be entitled to the full statutory benefits, it needs to be calculated individually.

Take the opportunity to book a cost-free consultation with us so that we can advise you on this.

Did you also know that thanks to recent changes in the law, employers are now under the obligation to provide with a company pension scheme? If you are a business owner and have not done this for you employees yet, or if you are not sure whether the plan your company is offering is your best option, we’re here for you. We will provide cost-free assistance in this matter, any day of the week. If you are an employer and are not sure if you have it or not and why this could make sense, please get it touch.

Americans: If you have a company pension scheme, please consider getting it checked since for Americans the investment strategy needs to follow specific criteria!

Third Layer

Consists of private pension insurance. It’s as flexible as it gets and, in our experience, also the most flexibly applicable to nearly all expats in Germany! If you want to find out how you can make use of these benefits regardless of how long you stay in Germany, we can provide you with a tailored analysis.

You can decide when you enter retirement. You can choose if you want to perceive the rent as a monthly payment or as a lump sum. And you are free in deciding what kind of investment you want to use as the engine behind this organism. You can receive it regardless of where you are in the world and even continue your contributions from abroad, which is also highly recommended. It provides you with security, especially for those expats who keep having to change countries.

If you want to provision for your children, too, this is also possible, affordable (see the compound interest effect below), and opens a lot of doors for their future, too.

Tax benefits: The winnings your investment makes go into the contract and do not need to be taxed with the 25% bracket as you would in open market investments. Staying in Germany for retirement? Then one more added benefit: from all pension planning products this one is the most tax-saving during retirement! You only have to pay taxes on the profits, with a bracket of merely 16-18%!

Which layer fits your situation?

Which of these layers makes sense to you depends on what your occupation is. This does not only mean the field of occupation but also the hierarchical position. The situation is not the same for a freelancer or a business owner or a student or an employee in a managerial position. Additionally, whether you have a family, whether/how long you want to stay in Germany, and several other variables are important too. If you want to know more about which one is the best for you ask us for a private consultation free of charge.

Okay now you know WHAT. But why NOW?

There are three reasons it is important to take action now:

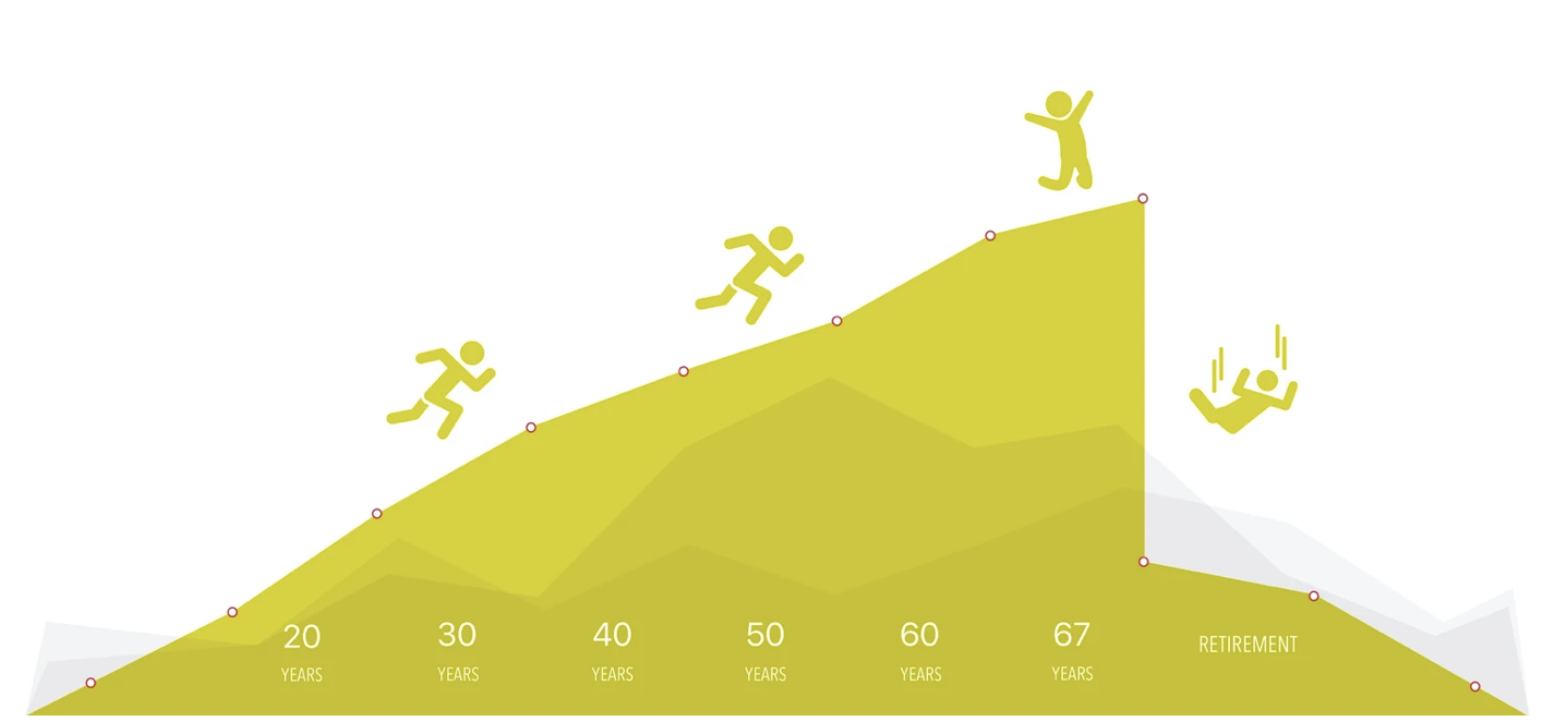

1. There’s no such thing as “too early”

Everyone faces an individual gap which increases as time goes by. What you receive from the social pension fund will be less than what you need to maintain your living standard. We calculate this for our clients on a daily basis. Especially with expats who have other sources of income across the world and have met the criteria to receive a little something here and there from further systems world-wide. The investment necessary for closing the gap depends not solely on the age you start at, but also on factors such as e.g. the inflation rate and your life span (among others). Here keep in mind that it is always better late than never. Nevertheless, we strongly advise in favor of investing small amounts for a longer period of time, to profit from the compound interest effect the most.

2. Benefit from the compound interest effect

Depending on the layer (see above which three layers exist) you invest your money in, there is low or high interest. A yearly interest increases your savings – and generates new interests anew.

3. You should not disregard how in the long run that can turn the situation profitable for you.

Most pension insurance products are investment-based, and there could not be a better time to invest than now. If you already have done something for your pension and want to check if everything is alright and that you are getting the best possible deal, we are also here for you. It is crucial that the investment underlying your products brings you the most worth out of your money and that it is periodically checked and updated.

Americans: Investment regulations are very strict in Germany, nevertheless, there are still many options to do something about your old-age that can be explored.

If you are interested in an individual calculation of how much capital you will need for sustaining your living standards reach out anytime, we can then see which strategy makes the most sense for you individually.

Special thanks to Max Meyer for putting together this article.