You’ve made the decision; you are going to try it on your own in Germany. Congratulations! Happy? Scared? Excited? Ready? Probably a little bit of everything. We know… we’ve been there! In this article, we share what we know for you to properly prepare yourself for self-employment in Germany and why it is worth it to free yourself from the statutory syste

Becoming self-employed has a big impact on almost all aspects of your life. From following your passion, registering your business, from finding customers to financial implications.

Even though all are equally important; in this article, we will focus on our passion: your financial planning as a self-employed expat in Germany.

The basic financial areas you need to get sorted for your self-employment in Germany

Being self-employed comes with a lot of freedom and with a lot of responsibilities. You need to not only take care of your personal finances but those of your company as well. Now that you no longer fall under the German social security system, the most important thing you need to know is how you can build a financial safety net effectively. To do this you need to know how the system works in Germany. The basic areas you need to get sorted are must-have insurances for both you and your company, how you can optimize costs and save taxes and the ways to secure your financial future. This article focuses on personal must-haves, for tips for entrepreneurs read this article.

Germany's Social Security System

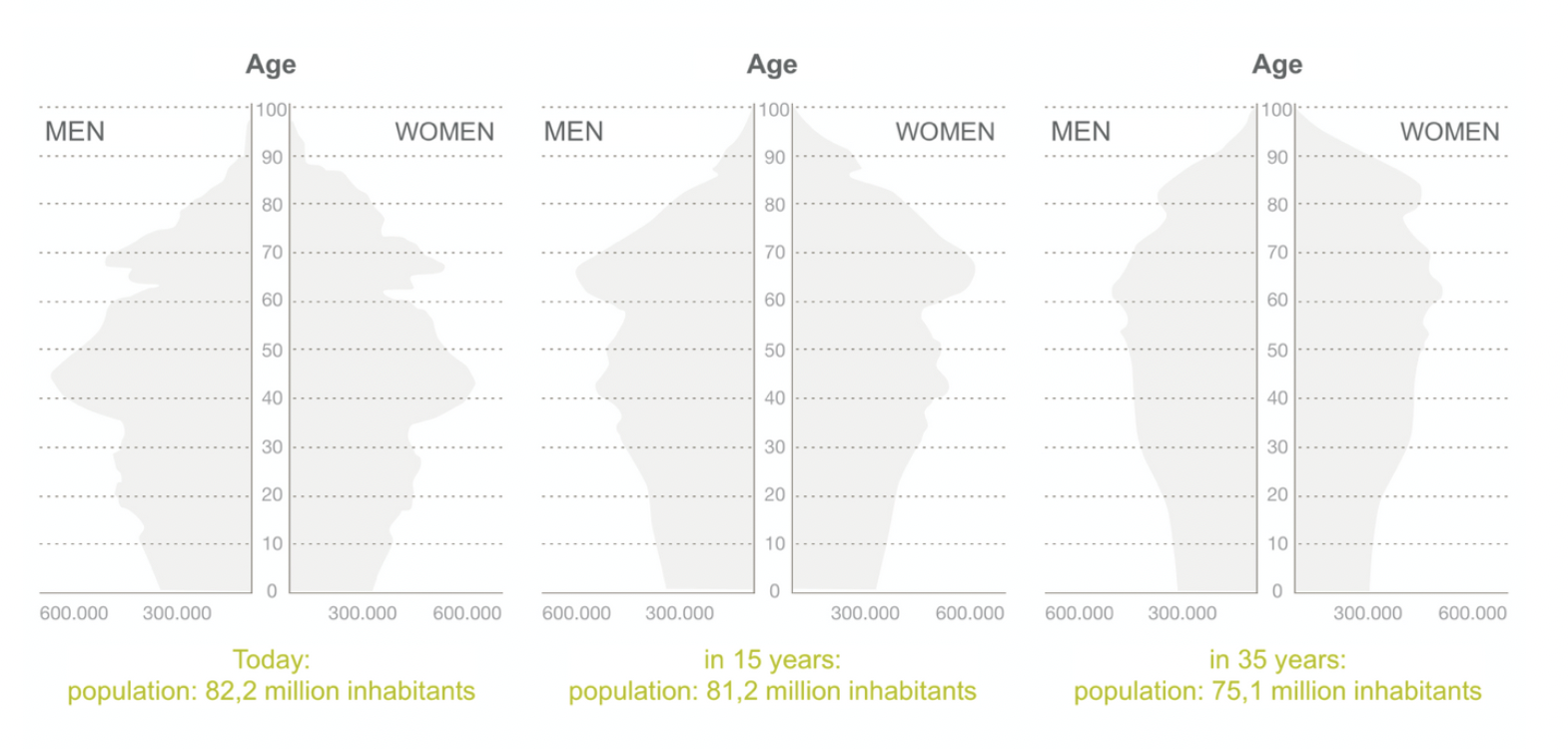

Fewer people being born, people living longer than expected, and more older citizens than current contributors to the system. These are the main implications of demographic change. What does it mean for you personally?

Here an example:

If you are an employee in Germany, 18.6% of your gross income is going into financing the pensions of the current pensioners. However, since this system is becoming increasingly inefficient, for over two decades now the state has been imploring workers to take out additional provision since what they will end up receiving will not be enough to sustain the same living standards contributors are used to during their working life.

Nevertheless: is not only the pension system which is flawed and affected by the demographic changes but the entire social security system.

Being self-employed you are now in the privileged position to part ways with the inefficient social security system for good, and make sure that all the contributions you make go into securing the future you envision for yourself.

You have 3 months to free yourself from the social security system, with aid of a specific form we are happy to facilitate and help you fill out.

Worried about whether you can still go for this and what the consequences might be if you did not already? Write to us, we will help you understand your situation better.

Bye, bye social security system:Hello, private opportunities!

Private Health Insurance is now an option

In Germany, we have a dual system. There is statutory health insurance (Gesetzliche Krankenversicherung) and private insurance (Private Krankenversicherung). If you want to learn more in detail about this refer to our article on this topic. If you are an employee, only once you earn over 62.550€ gross yearly (2020 numbers) you are granted to privilege to have the option to go private. Of course, depending on whether you have a family or not, if you are looking into a company pension scheme, or if you are over 55 that this should be addressed individually since any of these factors could play key roles into what the insurance looks like for you concretely.

If you are self-employed, congratulations: you now belong to a very select circle that qualifies you for taking out private health insurance! You do not only receive better and broader guaranteed coverage, but you also get to define it yourself. And you are not subject to budget and coverage cuts as you would be if you stayed in the statutory system.

Why go for it?

Apart from the broader coverage, the price advantage and flexibility are definitely deciding factors in the equation.

Want to know more? Get in touch for a personal free consult to see which coverage and premium options would fit your individual situation best.

Private Nursing Care Insurance: lower prices, more security

The coverage of statutory and private nursing care insurance are the same. Nevertheless, the premiums for the private one are more attractive and allow you to choose your desired sum insured.

Anyone with older relatives who have needed care might be aware of how demanding it can be and that to keep a decent living standard the prices are usually higher than what the statutory system usually pays. This ends up becoming a financial burden for the children, who then as adults have to channel their resources into filling that gap.

Why care about this now? Because we are all going to grow old and this insurance is an elemental one to make sure the wealth you are trying to build is not eaten up by you requiring care after many years of hard work since nursing care can be very expensive.

In the private insurance, you get to decide how much money you receive depending on how much care you might need (more about the different degrees of care needed on a different post).

Vocational Disability – when your workforce becomes compromised

Being self-employed means that you carry great responsibility on your shoulders, especially so if your work-force becomes compromised, given that your entire financial situation depends on your ability to work.

Causes of Vocational Disability for Academics

1 in every 4 academics undergoes a period of time where they become vocationally disabled at some point in their careers. Statistics regarding self-employed people and entrepreneurs are even more alarming. After all, it is no secret that being self-employed can become quite stressful at times. What if for any reason you happen to be unable to work anymore? If anything were to happen, would you not like to know that there would be a safe sum that is still going to flow in every month and substitute your income so that you can focus on healing?

This is indeed possible and fundamental for anyone, really. The statutory system is the most flawed in this area and even if you end up receiving some aid, it is definitely not enough to make ends meet in any way.

If you are still an employee you can profit from your current occupational group. We strongly advise you to take out this insurance in advance and secure normally better premiums.

One service we offer is a cost-free anonymous check of your health status, to check which companies would be willing to insure you. Get in touch if you would like to know more, we’ll walk you through the process.

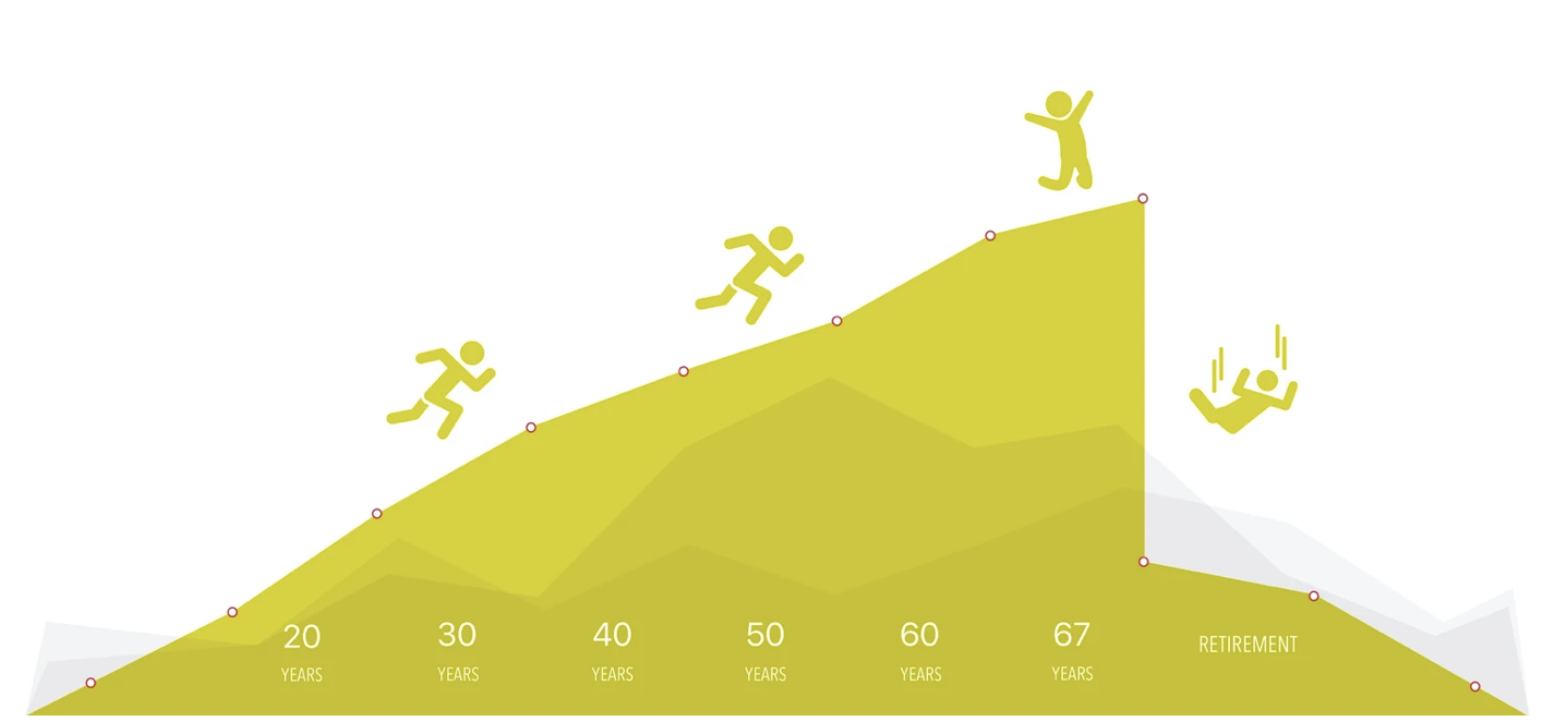

Pension Planning when self-employed

Self-employed people have much higher personal gaps compared to standard employees when it comes to their pension. Good news: you can save up for retirement while profiting from tax benefits more than anyone. Since you tend to earn more, you also have the opportunity to save more taxes if played wisely. You can add flexibility to your concept so that wherever the future might lead you, you can still profit from this investment in yourself for yourself.

Even if you are unsure about how long you might be in Germany, you can make sure you can do something for your future. Expats’ personal gaps are greater than those of the average German because of frequently changing countries without perceiving anything significant from any system. Self-employed expats have even greater needs and should definitely take advantage of what the market has to offer since you can reap the benefits later on, regardless where you find yourself spending retirement.

For more information on pension planning strategies and the German system read our other article on this topic

How do you properly cater to your personal financial needs?

The answer to that question: through accurate financial planning. In the same way, you will need a clear business strategy, you will no doubt need the right financial strategy to pair it with. From calculating your personal gaps in all fields related to lacking a security system to establishing a cushion you can fall back on if anything goes south, to strategies for creating wealth and reinvesting as to growing even bigger and catering to more people. Especially now, during these times of low-interest rates, investing can be the defining leverage needed to aid your business into growing into its next stage. Taking the leap into becoming an investor is, after all, the foundation of getting onto next-level entrepreneurship.

What does financial planning entail?

Financial planning is a lively process which begins with information flow, continues with trust and in-depth analysis, and ends with a business partnership where you can be entirely sure that regardless in which direction you pivot or whatever curve life throws at you, you are not only covered but thriving, through having someone at your corner helping you navigate through these changes.

First, you need to be able to tell what matters for you personally and where do you draw the line between what affects you personally and what concerns mainly your company. Then you need to know where you are and based on what you are aiming for, together with HORBACH Expats Team you will craft strategies and roadmaps that can in time lead you to that goal.

At HORBACH Expats we help people calculate and close their personal gaps on a daily basis. Self-employed people are very close to our hearts because we can walk them through this step-by-step 100% out of our own experience. Even if your German knowledge is rough around the edges or even non-existent, we are here for you. Our team takes care of making sure you are not the one who is forced to understand everything, but we make sure to make the situation and solutions understandable for you personally.

If you...

– are an employee planning to take the leap into self-employment and entrepreneurship and want to know which benefits you should be securing in advance

– realized you are missing some of these building blocks or are not sure if the ones you have are the best suited to your individual needs

– are looking for all-rounder solutions

Sign up for our cost-free consultations so that we can address your individual needs.