One thing that you simply cannot bypass in Germany is health insurance. But hardly

any other topic is surrounded by so many rumours and myths: which insurance is the

best? Who can choose private insurance? And is it true that you cannot "escape"

once you have decided to stay in the private insurance?

It is time to put an end to this confusion and make sure you know about your options!

So, let´s start with the basics. In Germany, there is a dual system: statutory health

insurance (Gesetzliche Krankenversicherung) and private health insurance (Private

Krankenversicherung).

First of all: Not everyone has the privilege to change into the private system.

Statutory health insurance

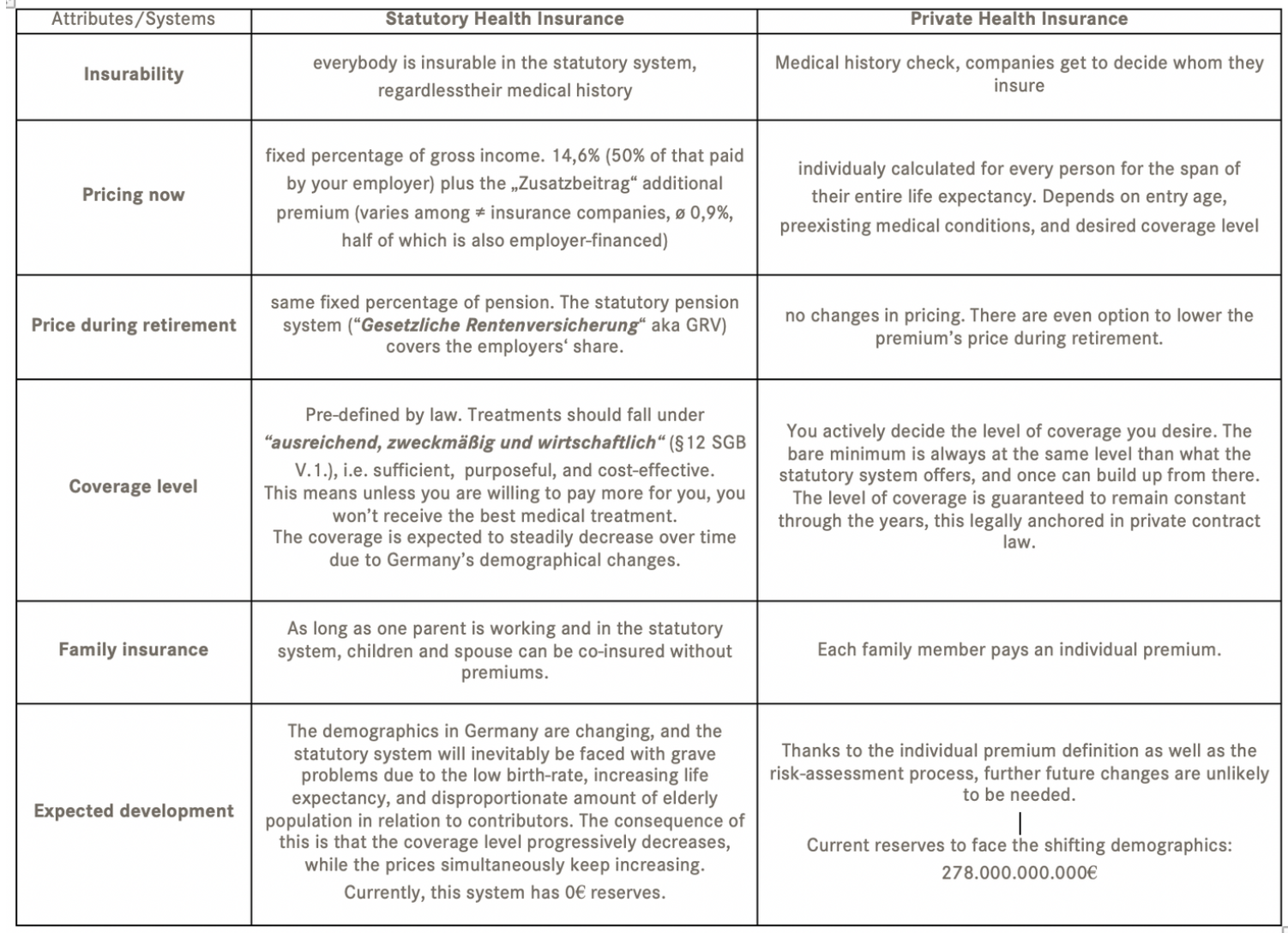

Generally, most people are obliged to be part of it: a majority of students, employees, artists and publicists are part of it. Although there is a vast market, the actual performance of the different statutory insurances is nearly equal by law. They may only differ in minor areas, such as small additional benefits for eyeglass wearers and the like.

So, who gets enjoy private insurance then?

Private health insurance

Only very select circles have access to private insurance. It depends on two factors; either you earn more than 62.550 € gross per year (in 2020), or you belong to certain professional groups such as officials, judges, soldiers and the self-employed.

What are the benefits?

Of course, private insurance is widely praised for the better coverage it provides. On top, you are the one who creates a care package based on the areas where you want to enjoy the favoured treatment. Correspondingly, you also have a say in how much you contribute monthly. Plus, you are not subject to coverage cuts in the long run as you would be in the statutory insurance.

As with all health-related insurances, the motto is the earlier, the better. Since the contribution depends on your health status also, it can be useful to document and save good health conditions early on to save money in the long-run.

You want to see how, or which options you have or put together your own care package? We welcome you to an individual session with our health care specialist!

And are you really trapped once you chose private insurance?

No! There are some scenarios that allow you to switch back:

- You are self- employed? Returning to the employee status allows you to return to the statutory insurance

- You are employed, but earn more than 62.550 € (2020)? A decreased salary after changing positions or working part-time makes the change possible

- You are an expat that is looking for the next country to live in? Moving away obviously separates you from the system

Nevertheless, the system is apt for staying with insurance in the long-run. That is why the individual situation and benefits of each case need to be considered thoroughly with each client.

And is it just bad news for everyone in the statutory insurance? No!

One of the biggest benefits is the costs. Usually, everyone who works is required to put up at least 9,3 % of their income to be part of the system, but many enjoy cost-free insurance! If the family´s single earner is part of the statutory insurance, this benefit opens up to most stay at home partners and children.

But what if you are not satisfied with the inferior performance of the statutory insurance?

Then we have good news! Luckily, you can increase the coverage of the statutory insurance in areas such as dental, ophthalmic, in-patient and out-patient care of their choice. The keyword: supplementary insurance! They can be combined individually and based on your demands to provide better care for you (and your family). Individual combinations and improvements are an area we are happy to discuss with you individually!

Do you want to know more about your options? Are you interested in saving money and the best conditions in the German market? Let’s talk about all the viable options in your personal session!